Cyber insurance market set to reach $14 billion

Cyber Insurance Market by Company Size (Very small companies ($2.5 Million to $99Million), Small-sized companies ($100 Million to $299 Million), Medium-sized companies ($300 Million to $1 Million), and Large companies ($1.1 Billion and Above)), and Industry Vertical (Healthcare, Retail, BFSI, Information Technology and Services) - Global Opportunity Analysis and Industry Forecasts, 2014-2022

Cyber Insurance Market is expected to garner $14 billion by 2022, registering a CAGR of 28% during the forecast period 2016-2022. The cyber insurance market is flourishing owing to increase in demand for cyber insurance policies. The growth is attributed to the rise in cyber-attacks such as coordinated cyber-attack on regional energy distribution companies in Ukraine, system breach of the health insurer Anthem Inc., breach of the White House's unclassified network, and massive customer data breach faced by LinkedIn and twitter. These incidents have adverse effects on businesses, and organizations have incurred huge losses owing to the same. As an outcome, growth in awareness about different cyber risks is witnessed in the boardroom which resulted in higher adoption of cyber liability insurance policies. The, C-suite levels have predicted that the market is expected to grow at double-digit figure, and a significant surge in demand for cyber insurance policies is also predicted.

Increase in cyber risk awareness among high executives and high cyber-related losses boost the market. Also, implementation of legislation regarding data security in emerging nations is also likely to drive the market. As a result, the insurance and reinsurance providers of the cyber insurance industry have taken upon this opportunity to secure high margins. However, complex and changing nature of cyber risks limits cyber insurance market growth.

To analyze the global cyber insurance market, the cyber insurance is segmented based on company size, industry vertical, and geography. Companies are categorized as very small companies ($2.5 million to $99 million), small-sized companies ($100 million to $299million), mid-sized companies ($300million to $1 billion), and large companies ($1.1 billion and above). Among all, large companies pay larger premium for cyber liability policies, as they need to pay high cost to recover losses. Different industry verticals covered in this report include healthcare, retail, financial services, information technology & services, and others (utilities, energy, education, government, manufacturing, construction, and transportation). The market is analyzed across four geographical regions, namely, North America (U.S. and rest of North America), Europe (UK, Germany, and rest of Europe), Asia-Pacific (Australia, Singapore, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Market segmentation

These days, companies of every size demand cyber insurance. However, highest levels of uptake of cyber liability insurance are observed among large corporations and SMEs. Industries such as financial institutions and information technology were early adopters of the cyber insurance policies. With the continuously developing technology, techniques of cyber-attacks also evolved and several other industries, namely, manufacturing, education, construction, energy, and utilities came into the purview of cyber-attacks. Among all these industries, the healthcare industry has found higher penetration of cyber liability insurance policies because huge third-party data such as is available with them.

North America, particularly U.S. dominates the cyber insurance market, and it is followed by Europe. Currently, Asia-Pacific has negligible share in cyber insurance market, however, the region is expected to show significant growth during the forecast period.

Asia-Pacific: A lucrative market for cyber insurance

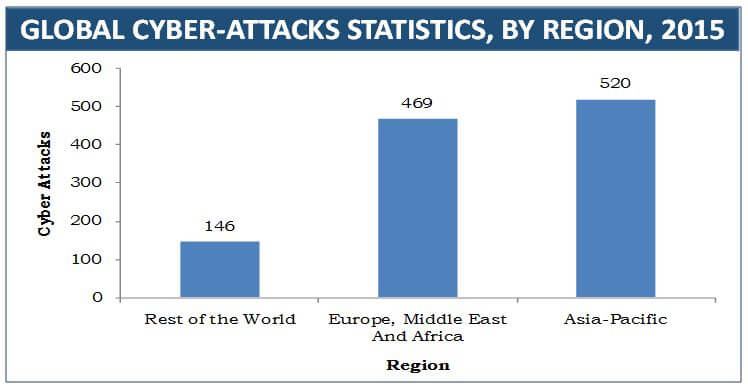

Data breach attacks during the initial days of November 2015 have increased in Asia. The region is considered as the top target for cyber-attacks, owing to poor protection against cyber-attacks in Asian companies. Countries such as Australia, New Zealand, Singapore, South Korea, and Japan which are collectively termed as “Cyber Five” are more vulnerable to cyber-attacks and South Korea tops the list.

Though cyber insurance market in Asia-Pacific is in its nascent stage, growth in cyber risk awareness along with the implementation of data breach legislation drives the market in Asia-Pacific. South Korea and Australia have already introduced these regulations while other countries such as China, India, Malaysia, and Indonesia are currently drafting corresponding bills. This is expected to result into an upsurge in the demand for cyber liability insurance policies.

Cyber insurance market in Singapore is projected to register the highest growth within the Asia-Pacific region. The growth is attributable to the rising number of organizations opting for services mitigating the financial and reputational risks associated with data breaches. Increase in automation and new interconnected technologies in Singapore have led to rise in cyber threats. Similar degree of growth is also expected in Australia owing to rise in usage of cloud computing technology and extensive use of mobile devices that have increased the need for data protection. A potential for insurance policies is seen in financial institutions and aviation markets. Other industries where a surge in demand is witnessed is information technology, healthcare, retail, and education.

Lack of standardized policies might refrain companies from buying cyber insurance policies

Traditional cyber insurance policies provided for protection against data loss. However, since 2000, policies are specially geared toward protection against financial losses incurred from data breach. After passing of the first state data breach notification law in 2003 by California, the demand for insurance coverage specifically designed to cover breach-related costs and liabilities increased. The complex nature of data risks and lack of standardized policies are projected to affect the market growth. The terms and coverage of policies vary from insurer to insurer thereby becoming complicated in nature. It is very difficult to manage evolving cyber risk owing to its increasing frequency, complexity, and type of cyber-attack. This hazard has left several gray areas full of differences in the industry and demands flexibility in cyber risk management tools. Therefore, lack of standardized policies inhibit the market growth.

Read more:https://www.alliedmarketresearch.com/cyber-insurance-market